At the level of federal law, the United States has legalized medical marijuana and industrial marijuana. Biden’s election will further liberalize recreational marijuana, and the marijuana industry will usher in a wave of good investment opportunities.

Under the current development situation, this article mainly introduces the summary of industrial marijuana and its development in the Chinese market.

1. Overview of the marijuana industry.

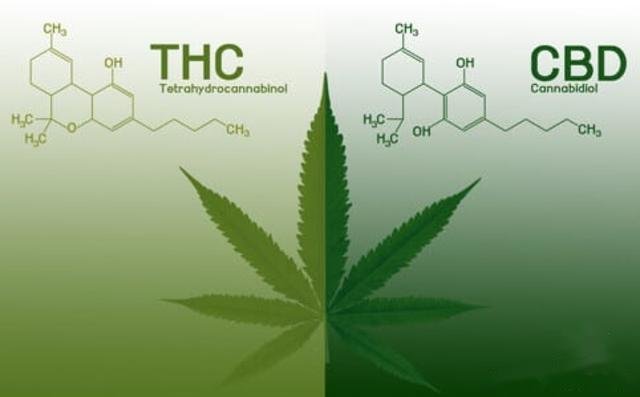

Marijuana is mainly divided according to tetrahydrocannabinol (THC) content, divided into two categories: recreational marijuana and industrial marijuana. Based on safety considerations, in recent years, countries have adopted the uniform standards developed by the European Commission, which classify marijuana into three categories according to the content of THC:

Industrial hemp: THC < 0.3%, not showing mental activity. Cannabis diphenol CBD is a vital compound extracted from industrial hemp.

Recreational cannabis: THC > 0.5%, with apparent mental activity and abuse tendency, medicinal tendency;

THC is between 0.3% and 0.5%, and the mental activity is low. It belongs to the medical variety between industrial cannabis and recreational marijuana.

In China, industrial hemp is called China hemp, used as a food crop, cash crop, and industrial raw material. Cannabis diphenol (CBD), which has a medical effect in industrial hemp, can treat various chronic severe diseases.

The industrial chain of industrial marijuana is as follows:

I. Up stream: Branding, Planting

It is located in the upper reaches of the industry with low added value

II. Middel: Extraction, Processing

The purpose of extraction is to obtain the most valuable CBD in industrial hemp. The main extraction methods of CBD are carbon dioxide extraction, solvent extraction, and dry ice extraction. The extraction method with skilled technology still occupies the mainstream position.

III. R&D and sales

The most profitable links in the industrial hemp industry chain are research and development and sales. The downstream application has a broad prospect, covering the three primary uses of industry, medical treatment, and consumption.

Industrial applications: paper products, chemical raw materials, lubricating oils, textiles.

Medical applications: it has the effects of relieving pain and anti-inflammation, anti-epilepsy, anti-cancer, anti-anxiety, treatment of depression, etc., and provides biomedical raw materials for cancer, epilepsy, and Parkinson’s disease.

Consumption applications: due to the role of improving sleep quality and immunity, it can be added to food, beverages, and health products; because of its antioxidant, anti-inflammatory, and anti-acne effects, it can be used in skincare products.

2. Industry Situation

(1). Marijuana market scale

① The size of the global marijuana market

The global legal marijuana market, industrial marijuana market, and cannabinol market are large-scale and are increasing rapidly in the future.

| Types of the marijuana market | Market Scale |

| Legal Marijuana market | √ Legal marijuana includes all kinds of marijuana that comply with local laws; √ According to Euromonitor International, in 2018, the global marijuana market was about 150 billion US dollars and the legal market was about 12 billion US dollars; √ As the legalization process of the industry continues, by 2025, legitimate products are expected to account for 77 percent of the market, reaching 166 billion US dollars. |

| Industrial hemp | According to Zion Market Research, the global industrial marijuana market was about $3.97 billion in 2018 and is expected to reach $9.64 billion by 2025. |

| Cannabis diol (CBD) | According to Eior Markets, the global CBD market was $1.454 billion in 2018 and is expected to reach $17.346 billion by 2026. |

In the marijuana industry, the CBD market is growing most rapidly. The US CBD market is currently in a stage of rapid development. In 2018, US CBD sales were 52.71 million US dollars, increasing 332.8% compared with 2017. In 2019, the US CBD market grew by 700%.

② The scale of the CBD market in China

According to the statistics of the Food and Agriculture Organization of the United Nations, Europe, China, South Korea, and Russia are the primary producers of industrial marijuana in the world, of which China has the largest planting area, accounting for about half of the world.

By the end of 2018, the market size of the cannabis diol (CBD) industry in China is nearly 600 million yuan, and it is expected to reach about 1.8 billion yuan in 2024. In the future, with the in-depth exploration of the various efficacy and value of cannabinol, the market scale will continue to expand.

(2). Driving factors of industry development

① Government policies

The policies overseas continue to open up and apply, and China’s policies support industrial development. The legalization process is accelerated.

In the past 3 years, countries worldwide have gradually liberalized the relevant policies in industrial marijuana, and the legalization of industrial and medical marijuana is the intended trend for many nations.

By the end of 2018, 41 countries have declared medical marijuana legal. More than 50 countries have declared CBD legal. The main markets are concentrated in Europe, the United States, and other developed countries.

| Country | Policy liberalization |

| Canada | √ In 2001, the government legalized national medical marijuana. √ In June 2018, the Canadian Senate passed Canada’s federal marijuana bill. √ In October 2018, the Federal Cannabis Act entered into force, making Canada the second fully legal country in the world after Uruguay, allowing the cultivation, processing, and sale of cannabis and its derivatives. |

| America | In December 2018, the President of the United States signed the Agriculture Act, which removes marijuana with a THC content of less than 0.3% from the controlled substances Act, legalizing industrial marijuana nationwide. |

| Germany | In 2017, Germany announced that patients with serious illnesses could use medical marijuana products. |

| New Zealand | In 2017, New Zealand announced that doctors could prescribe approved CBD products. |

| Brazil | In 2017, the first cannabis drug license was issued. |

| Argentina | In 2017, Argentina passed a bill legalizing the medicinal use of marijuana. |

| South Korea | In 2018, South Korea became the first country to legalize medical marijuana in East Asia. |

| The United Kingdom | In 2018, the British government-approved medical marijuana. |

| Thailand | In 2018, the National Legislative Assembly of Thailand approved the marijuana bill, which provides opportunities for medical research on marijuana and the treatment of diseases under the supervision of doctors. |

China’s policy supports industrial development, and legalization is accelerated. Since 2019, several listed companies have participated in the process of the marijuana industry by obtaining licenses for planting and processing. Yunnan, Heilongjiang, and Jilin have been approved to develop industrial hemp.

| Province | Main Policy |

| Yunnan Province | √ In 2013, Yunnan Provincial Government formulated and implemented; √ In 2010, the Yunnan provincial government issued a document to clarify that industrial marijuana is legal; √ In May 2019, the Department of Science and Technology and the Department of Finance of Yunnan Province listed industrial marijuana as a critical investment project in the Yunnan industry. √ In October 2019, Yunnan Industrial Hemp Investment platform-Yunnan Industrial Hemp Industry Investment Co., Ltd. was officially unveiled. Its actual control is the Yunnan State-owned assets Supervision and Administration Commission. |

| Heilongjiang Province | √ came into effect in 2017. On the premise of ensuring safety, the principles let industrial marijuana serve the development of the economy. √ In July 2019, the Heilongjiang government hosted the 2019 International Symposium on Industrial Hemp Industry to discuss the development of industrial marijuana. |

| Jilin Province | In March 2018, the Jilin provincial government took “industrial marijuana management” as a separate chapter. It stipulated the definition and nature of industrial marijuana and breeding, planting, processing, marketing, and other links. It is explicit about strengthening supervision of the industry under the condition of orderly liberalization. |

② Scientific Research

Scientific research has proved that the diversified efficacy of industrial marijuana is the basis of policy opening.

Various studies have shown that cannabis diphenol (CBD)-based industrial hemp extract can treat multiple chronic diseases, with obvious anti-inflammatory, analgesic, and anti-anxiety effects.

The drug’s price is determined according to the amount of cannabinol contained in it. The higher the content, the higher the price and the greater the profit.

At the same time, the efficacy of CBD in the consumer field has attracted the attention of major consumer goods brands. It has gradually entered the industrial hemp field since 2018, with great potential for application in the industry.

(3). Limiting factors of industry development

① Liberalized or not on policy

Whether the policy is liberalized or not has an essential impact on scale.

The rapid development of the industrial hemp industry depends mainly on the degree of liberalization of the policy, which is an important factor restricting the cultivation, processing, sale, and use of industrial marijuana and directly impacts the scale of the industry.

| America | Although the Agriculture Act of 2018 legalizes industrial cannabis at the federal level, the extract CBD is still regulated. |

| China | √ It is mainly driven by local governments, lacking explicit norms at the national regulatory policy level. √ Local government supervision is prone to normative differences and regulatory loopholes. √ There are some similarities between industrial marijuana and recreational marijuana. √ The approval of the license policy makes it more difficult for the industry to enter. |

② CBD purification technology

The large-scale use of seeds with high CBD content is uncertain, and the upgrading of CBD purification technology affects the development of the industry.

Seeds with high CBD content have more advantages for industrial hemp production. Still, high CBD content is usually high in THC content, which brings mental activity and abuse tendency, and is regulated by the government.

The restriction of THC in China is stringent. At present, domestic scientific research institutions are committed to improving the content of CBD in varieties and controlling the content of THC at a low level.

Europe, the United States, and other developed countries also have restrictions on the transportation of CBD products with high THC content. The above reasons make the seeds with high CBD content be used on a large scale. The content & purity of CBD also affects the profit margin of the industry and the scale of development in the future.

(4). The current situation of the industry in China

① Seed research and development

At present, there is a big gap in CBD content between Chinese and foreign seeds.

Because of the strict restriction of THC in our country, scientific research institutions are committed to increasing the content of THC in seeds on the premise of controlling CBD content.

| International | The CBD content of some foreign seeds can reach 10%. |

| China | √ The CBD content of representative seeds is about 1.2%. √ In November 2019, Hemp Biology under HMI Group and Hemp Research Institute of Chinese Academy of Agricultural Sciences jointly developed seeds with 3.19% CBD content. |

② Product application

Cosmetics is currently the commercial sector where hemp leaf extract is allowed in China. At present, several listed companies have taken the lead in CBD makeup and skincare products, such as Kunming Pharmaceutical Group’s KPC hemp leaf skincare products and Kangnbei’s cherished cannabis leaf eye mask have been listed.

In addition to the cosmetics field, some listed companies also produce and sell other application products. Still, due to the lack of a clear opening policy in the domestic market, most listed companies’ products are sold to foreign markets.

3. The development of related enterprises

(1). Major foreign enterprises

Companies engaged in the purification, processing, and sale of cannabinol are highly profitable, but their expenses are also high.

The leading international industrial hemp enterprises are Canopy Growth Corp, Aurora marijuana, Tilray, and Aphria.

The gross profit margin of the industry is exceptionally high, with a gross profit margin of about 80% in 2017 and an average gross profit margin of more than 90% in 2018. Still, the industry’s net profit margin is low or negative, mainly due to ultra-high R & D and sales costs. The hemp industry belongs to the industry with a high expense rate and high expenditure. In the planting link, many funds are needed in the land, seedling cultivation, breeding, technology, etc.

They are improving the added value of products, whether the purchase of patents or independent research and development, which requires a lot of expenditure. The subsequent sales expansion also brings significant sales costs.

At present, most of the foreign companies in the industry with the highest market capitalization are operating early, concentrated in 2013-2014, and now have a deep layout in the industry. At the same time, they also actively structure the industrial chain of the upper and lower reaches of the hemp industry. On the one hand, it improves its independent research and development enthusiasm. It urges the company to price its products actively, and on the other hand, it also enhances the ability to cope with the price fluctuations of upstream raw materials.

From the perspective of the industry chain, the downstream applications in the marijuana industry chain have room for growth and high added value, so the market gives higher valuations to companies that are ahead of their competitors in terms of “application products.” On the one hand, these companies maintain high R & D investment and raise competition barriers. On the other hand, they cooperate sincerely with giant applications enterprises, creating a win-win situation.

(2). Major Chinese enterprises

Since 2019, more and more listed companies have carried out industrial marijuana-related business.

The domestic layout is mainly divided into direct participation and equity investment. Due to developing foreign consumer markets and lower labor and land costs in Southeast Asian countries, enterprises are also actively expanding overseas.

| Direct participation | √ The company applies for a license directly. √ Directly participate in the cultivation of industrial marijuana and other links. |

| Equity investment | √ Gain related income by taking a stake in an industrial hemp company. |

① HMI Group

HMI Group is a China industrial hemp chain investment company, which grows, extracts, develops, produces, and sells industrial marijuana-related products worldwide. Its products cover bio-pharmaceutical, daily necessities, textile fibers, composite materials, biomass energy, and other fields. The company is the only licensed company in China with an industrial marijuana planting license and hemp mosaic processing license and is in line with China’s GMP.

② Meilleure Health International Group

Meilleure Health International Group(02327.HK)is an international health industrial group listed on The Stock Exchange of Hong Kong Ltd (HKEx). Business cover Heath Medical Care, Health Tourism, Health Real Estate, etc. It is also the first listed company to invest cannabis health industry.

In 2018, they began to lay out the field of industrial marijuana, focusing on promoting the health industry of marijuana and deeply laying out the whole industrial chain of medical marijuana, covering biopharmaceuticals, health food, medical consumables, beauty cosmetics, and other fields.

Enter into a framework agreement with HMI Investment Group to obtain a 20% stake in Hempsoul and cooperate by introducing HMI Group as a strategic shareholder and jointly investing in a factory.

In 2019, the sales income was 210 million yuan. The operating profit was 23 million yuan, and the net profit was-18 million yuan.

③ Fuan Pharmaceutical ( Group) Co.,Ltd

Fu’an Pharmaceutical Co., Ltd. is mainly engaged in the research, development, production, and sales of biomedicine. In March 2019, it entered the industry by acquiring industrial marijuana growers and processors. In the future, it will go deep into the industrial marijuana and medical marijuana industries and expand overseas markets.

In 2019, the sales income was 2.781 billion yuan, and the net profit was 293 million yuan.

4. Future development trend

1. FDA in the United States is expected to introduce a policy on CBD application. Biden will further promote the development of the marijuana industry in the United States, positively impacting the policy liberalization of other countries.

2. China’s policy attitude is expected to change from “control restriction” to “control support.”

5. Conclusion

In the short term, the industrial hemp industry is in the concept introduction period, mainly subject-based investment opportunities, which is difficult to reflect in the income and profit of listed companies.

In the medium term, with the change of domestic policy and the emergence of new application scenarios of related products, corporate income and gross profit will be partially realized by the impact of product landing.

In the long run, the development of industrial hemp highly depends on the continuous embodiment of the value of CBD and the degree and speed of policy liberalization.